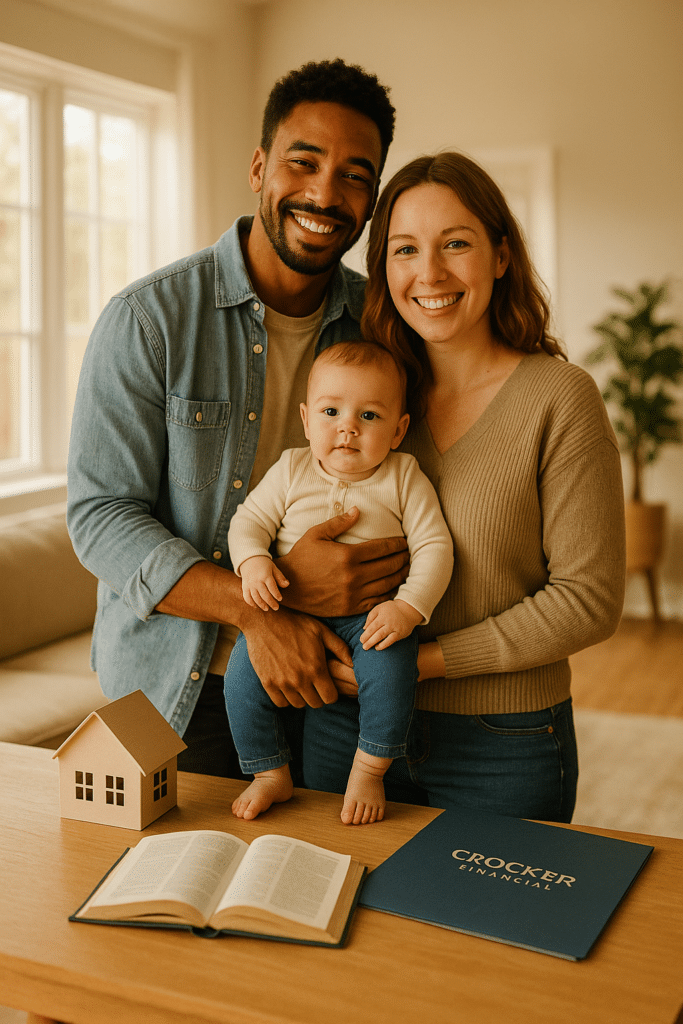

Buying your first home is exciting — but it also comes with new responsibilities. One of the most overlooked steps new homeowners face is protecting that home with the right life insurance. In this guide, we’ll explain why life insurance matters for first-time buyers, the different options available, and how to choose the best plan for your family.

Why Life Insurance Matters for First-Time Homebuyers

- Protect your mortgage: If something unexpected happens, your loved ones won’t be burdened with payments.

- Safeguard your family: Life insurance provides income replacement to cover bills, childcare, and living expenses.

- Peace of mind: Knowing your home is secure gives you confidence as you build your future.

Common Questions First-Time Buyers Ask

“Do I really need life insurance right now?”

Yes. Even if you’re young and healthy, life insurance is at its most affordable stage now. Waiting often means higher costs later.

“What type of life insurance should I choose?”

Most first-time buyers start with term life insurance. It’s affordable, straightforward, and designed to cover your mortgage and family for a set period (10, 20, or 30 years). As your needs grow, you can later explore permanent insurance for long-term wealth building and legacy planning.

“How much coverage do I need?”

A good starting point is coverage that equals your mortgage balance plus 5–10 years of income. This ensures your family can stay in the home and maintain their lifestyle.

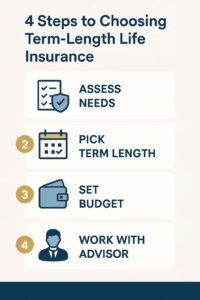

Step-by-Step: Choosing Your First Policy

- Assess your needs: Look at your mortgage, debts, and monthly expenses.

- Pick your term length: Align it with your mortgage payoff timeline or major family milestones.

- Set a realistic budget: Affordable options exist, even with student loans or other debts.

- Work with a trusted advisor: Choose someone who explains clearly, without pressure, and aligns with your values.

Faith and Family: Protecting What Matters Most

At Crocker Financial, we believe your home isn’t just a house — it’s the foundation for your family’s future. By protecting it with life insurance, you’re living out stewardship, safeguarding your loved ones, and planning for generations to come.

Ready to Protect Your Home and Family?

Don’t wait until it’s too late. Start with a free, no-pressure quote today and discover how affordable peace of mind can be.

Frequently Asked Questions

Is mortgage protection insurance the same as life insurance?

No. Mortgage protection is one type of life insurance designed specifically to cover your home loan. Broader life insurance can also provide income replacement, debt payoff, and legacy benefits.

How soon after buying a home should I get life insurance?

Immediately. The earlier you apply, the lower your premiums will be, and your family’s protection starts right away.

Can I adjust coverage as my needs change?

Yes. Policies can be reviewed annually and adjusted as you grow your family, pay down debt, or build wealth.